10 minute read

With a historic deficit looming what can the FBR do?

The economic slowdown might send FBR searching for new avenues of tax collection. Does it mean bad news for existing taxpayers?

By Ahtasam Ahmad & Shehzad Pracha

Advertisement

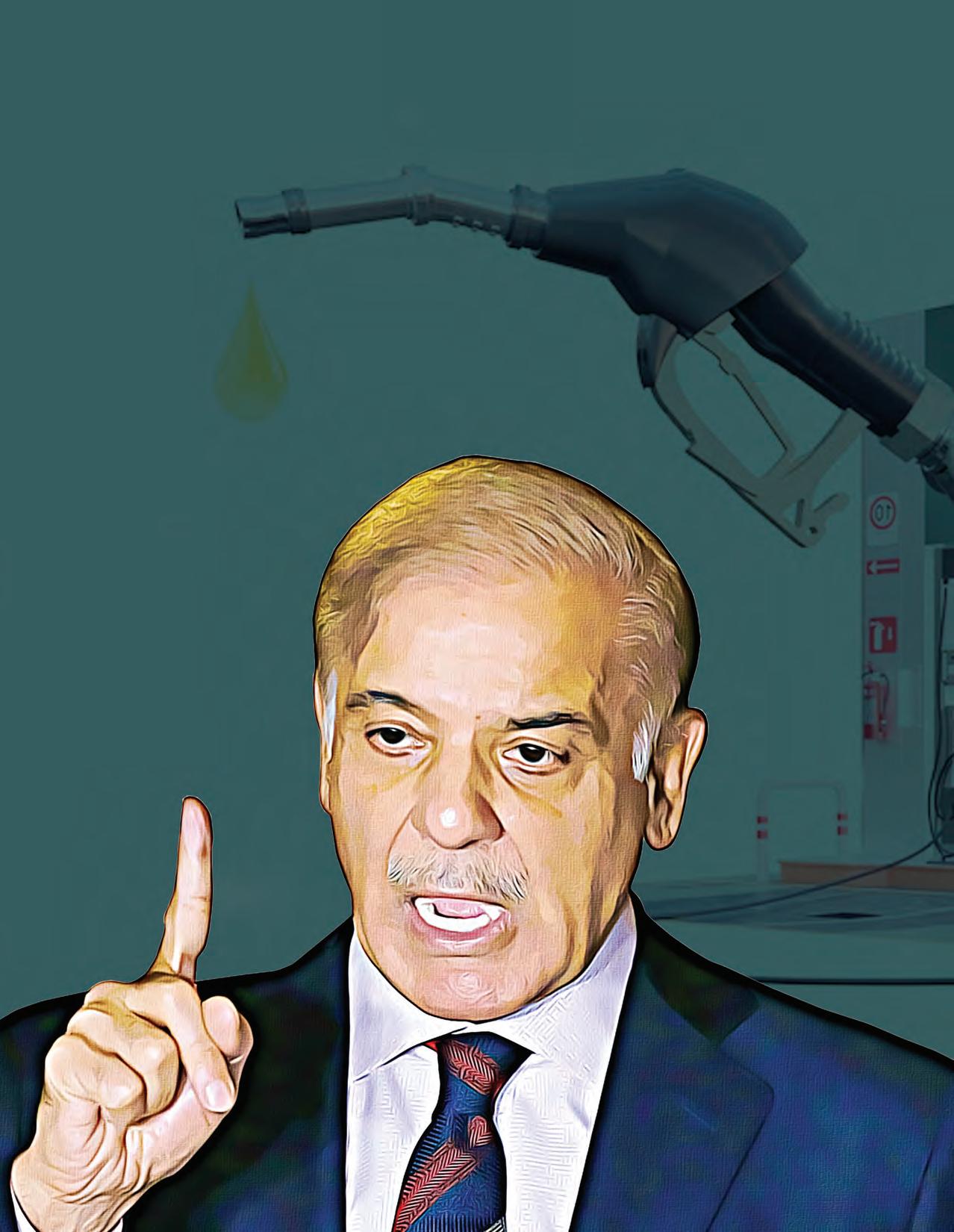

Prime Minister Shehbaz Sharif is staring down the throat of a tiger. His newly cobbled together coalition government might be swallowed up by any one of the many crises that it has inherited. Not only is the country facing massive inflation and an energy crisis unlike any other witnessed in recent times, the new government will also need nerves of steel when they present the budget for the next fiscal year in only a couple of months.

In the budget, Pakistan is facing a historic deficit. The balance of payments is completely out of whack, the import bill is soaring because of global fuel prices, and some tough calls need to be made. In the wake of all of these rising expenditures, the Federal Board of Revenue (FBR) is under scrutiny. Can they beef up tax collection by netting some big fish?

In the last few weeks, the board has initiated recovery of tax liability against multiple companies including those in the Telecom, Fertilizer and Cement sector. On the receiving end of the FBR’s attempt to meet collection targets were companies like Zong, Telenor, Jazz and operators in the cement & fertilizer sector as well as the National Highway Authority. The income tax disputes in these cases are based on multiple underlying factors ranging from disallowance of various expenses to differences in interpretation of certain sections of the law.

It is not a coincidence that the tax regulator is on a recovery spree at this particular time. The expected economic slowdown leading to curbing imports as well as the tax relief provided on multiple commodities, most notably petroleum products, has made the collection of targeted 6.1 trillion rupees in taxes

an uphill task.

During the same period, the FBR released its provisional figures of tax collection for the month of March 2022. The collection target for the said month was not achieved, a recurring occurrence, as the regulator failed to achieve the target in three out of the last four months.

Further, this was the first time that the board released collection figures that were in excess of the amounts actually received in the banking system. The provisional figures were anchored on the expected recoveries from actions initiated against companies.

The structural flaw

The structural flaws of Pakistan’s tax system are well documented. The reliance on a narrow tax base and exploitation of existing taxpayers on top of a complex tax system all adds up to the difficulty in increasing the tax revenues leading to a low GDP to Tax ratio of around 9%. As per the study, Tax Structure in Pakistan: Fragmented, Exploitative and Anti-growth, by Pakistan Institute of Development Economics, “Ad-hoc tax revenue enhancing measures through SROs and mini-budgets have developed a complex tax system that confounds principles of rational tax policy. FBR sets an ambitious target and to chase that number arbitrary measures are taken which create uncertainty that eventually kills transactions. These unrealistic targets cannot be achieved without enhancing the taxable capacity of the country; instead these are stifling economic activity.” The study further added, “The current tax structure in Pakistan is regressive in nature and is in contrast to the fairness principle of tax policy. Frequent changes in policy and rates make the environment is very uncertain, especially for potential investors.” Syed Asad Ali Shah, A Senior Chartered Accountant and Former Managing Partner of Deloitte Pakistan, while talking to Profit stated, “The FBR has failed to take effective measures in broadening the tax base and instead has relied on exploitation of those in the existing tax net.” 20

The nature of tax disputes

In the telecom sector, the recent cases of recovery include that of Telenor and Zong. The latter was at the receiving end of a tax recovery of Rs4.1 billion due to a difference in estimation of advance tax for the first quarter of the tax year 2022. The recovery against Telenor amounted to Rs3.5 billion for a case that dates back to 2015. Jazz, anticipating future attempts by FBR for seizure of accounts, resolved its major tax cases out of court through an Alternate Dispute Resolution Committee in November 2021. However, its accounts were still seized for a recovery of Rs5.7 billion in march 2022 against failure to meet an advance tax demand. It is pertinent to note that in all these cases, the companies were able to get a stay order from the high court. The fertilizer sector was also sent notices of recovery recently. The matter of contention in this industry was sales to unregistered persons while the industry claimed that it had an exemption as per previous FBR instructions. Fertilizer Manufacturers of Pakistan Advisory Council (FMPAC) Executive Director explained that Post promulgation of the Tax Laws (Second Amendment) Ordinance 2019, input GST was disallowed on sales made to unregistered persons exceeding Rs10 million in a month / Rs100 million in a financial year, adding significant exposure for the fertilizer industry. After due deliberation, FBR issued a notification (SRO 1337) in December 2020, whereby exemption would be granted subject to the provision of dealers’ information, including bank account etc. to FBR. The common pattern amongst all the cases mentioned above and other happening in the recent time is recovery through seizure of bank accounts. Last year, in October, FBR revoked the clause in the Section 140 of the Income Tax Ordinance (ITO) 2001 which compelled the regulator to give a 24 hour notice to taxpayers before seizing their accounts. Shabbar Zaidi, the former chairman of FBR and the one who brought in the law of a 24 hour notice before recovery, while talking to a private publication stated, “I am personally sorry to hear the withdrawal of the first instruction issued when I joined as chairman FBR.”

He further added, ““[There should be] no freezing of bank accounts without intimation and approval from chairman FBR. Due to this there was a major relief to taxpayers.”

However, FBR officials were of the point of view that if the prior channel of approval (implemented by Zaidi) was followed, there were chances of information getting leaked and the taxpayers withdrawing the money from their respective accounts.

“The recent events of bank accounts seizure are an example of the FBR trying to meet the ambitious revenue targets. However, going after the complaint taxpayers, especially the Telcos are uncalled for”, Syed Asad Ali Shah commented on the situation.

Tax litigation

The cases of income tax recovery that have unwinded in the past few months have mostly been in litigation at multiple forums. As per data revealed to the Islamabad High Court (IHC) in February, more than 90,000 tax cases were pending at different litigation forums amounting up to Rs3.5 trillion. However, 80 percent of these cases were pending with FBR’s internal litigation forums. The litigation process at the commissioner level is also influenced by the FBR as per reports, in September last year commissioner appeals in jurisdictions were asked to report to their respective heads of regional and large tax offices, an order that imposes a conflict of interest situation for commissioner appeals who is responsible for smooth and fair trial of tax litigations. Senator Talha Mehmood, while chairing a meeting of the standing committee of finance in October last year, confronted FBR representatives over influencing the commissioners appeals to decide cases against taxpayers. Further as per Profit’s sources, influ-

encing decision makers at different internal litigation forums of FBR is a common practice and is specially employed when the tax recovery wing of the regulator seeks to expedite the recovery process. However, most of such cases don’t hold in court of laws and immediate stays are granted.

Syed Asad Ali Shah, A Senior Chartered Accountant and Former Managing Partner of Deloitte Pakistan, commenting on the recent developments stated, “In all likelihood, FBR will expedite the cases under litigation specially in their own tribunals. However, demands at times are frivolous and cannot be held in a court of law. The bank seizure process is also likely to speed up as the pressure mounts on the regulator.”

Difficult times ahead

As per the recent figures released by FBR, it collected around Rs575 billion in March 2022, against a target of Rs604 billion. Further, it missed its target in three out of the last four months.

The disaggregated figures show that around 52% of tax revenues were collected from imports. This has been possible as the local demand surged amid expansionary policies by the government. Therefore, for the first three quarters, FBR was not only able to achieve its revenue targets but also exceed them.

However, as the fiscal tightening occurs and rupee depreciates, the main source of revenue, imports, is likely to be reduced putting pressure on the board to find alternate means of revenue collection. Additionally, the tax exemptions on multiple items specially petro-

Syed Asad Ali Shah, former managing partner of Deloitte Pakistan

leum products has cost the tax regulator heavily. As per FBR’s own figures, for the month of March, the tax exemption on Petroleum products has cost them around Rs45 billion in revenue while exemptions on Fertilizers, Pesticides, Tractors, Vehicles, and Oil & Ghee amounted to Rs18 billion forgone in potential revenue. While zero ratings on Pharmaceutical Products translates into Rs10 billion of tax revenue not collected. Further, a fall in commodity sales like cement is also likely to put pressure on FBR in the coming months.

Therefore, it is likely that the board will go after those in the existing tax net to meet its ambitious tax targets. However, frequent notices and bank account seizures all add up to the lack of ease of doing business argument in Pakistan.

Ashfaq Tola, the President of Institute of Chartered Accountants of Pakistan and a Senior Tax practitioner commented, “The recent surge in recovery is something that is in line with what we see in the past years. As the fiscal tightening curbs imports, FBR will be under pressure to meet its targets and that would result in more notices for the businesses in the coming months.”

As per Overseas Investors Chamber of Commerce and Industry’s Taxation Proposal 2022-23, “A compliant sector provides FBR with information of registered/unregistered businesses, which FBR should use as a tool for broadening tax net. However, FBR unfairly penalizes these commercial organizations by disallowing their legitimate expenses and input Sales tax through measures covered in Income Tax Ordinance and Sales Tax Act.”

“Revenue Targets for field formations should be in line with the business growth trends. Unrealistic targets lead to harassment of compliant taxpayers”, The proposal further added. The incumbent government led by PML-N is widely perceived as a business friendly one and therefore, it would be expected to reform the FBR to end taxpayer difficulties. However, there is not much that can be done by this government as they are bound by the commitments to IMF and as per experts, the existing policies of FBR will be carried in the upcoming budget. n