What’s up on the PSX? The stock market performance

T

By Saad Tanvir

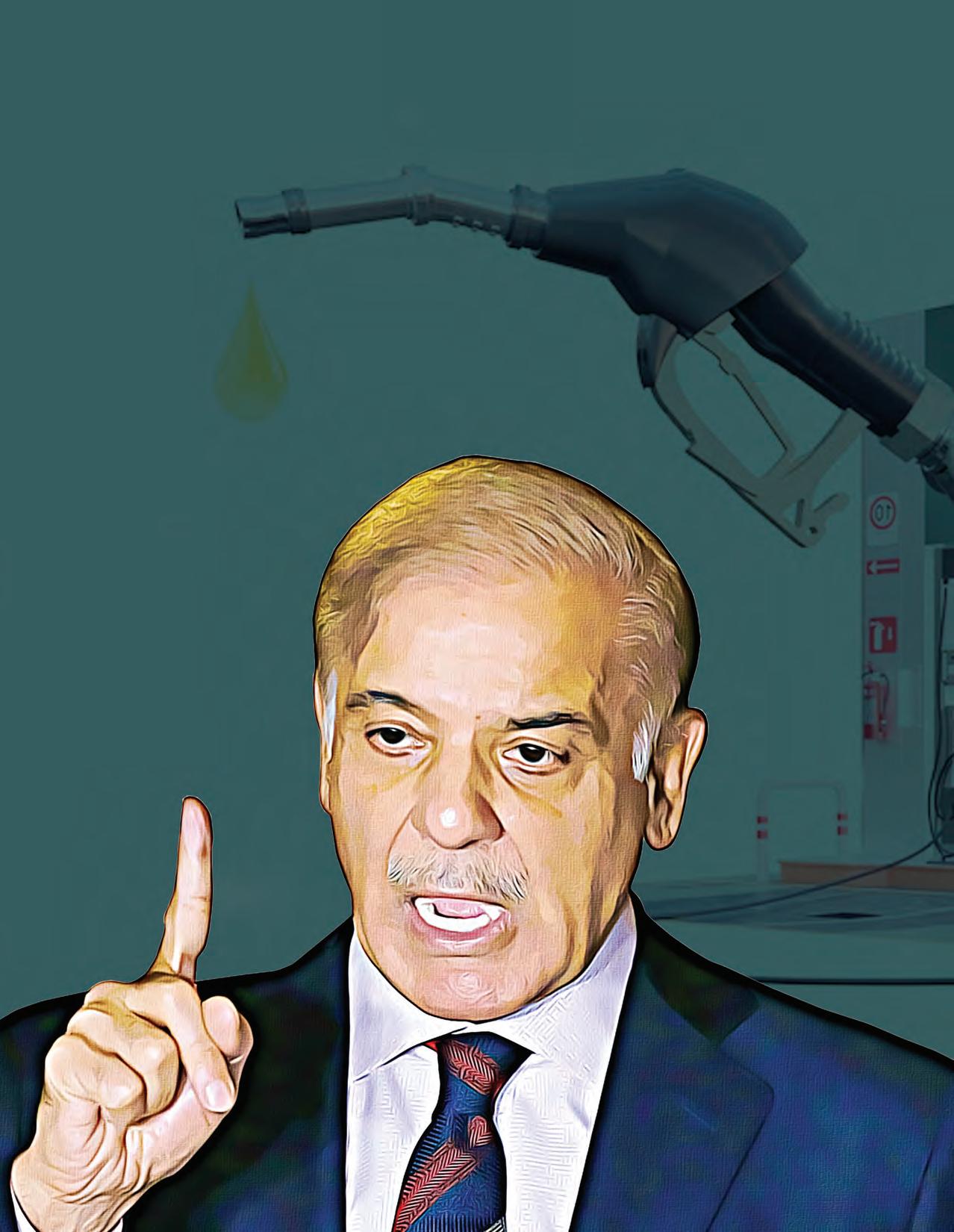

he outgoing week witnessed a return of the bulls to the local bourse mainly due to clarity on the political front with the successful passage of No Confidence Motion against the PM which resulted in the election of Shehbaz Sharif as the country’s new Premier. However, the noise has not yet settled and is expected to remain high as the ousted govt. of Pakistan Tehreek-e-Insaf (PTI) vows to hold nationwide protests until new elections are called. Moreover, questions on the economic front have resurfaced as members of the new cabinet are being finalised. The expected incoming Finance Minister, Mr. Miftah Ismail, has reiterated that the IMF is a top priority of the newly formed govt, and talks regarding the 7th Extended Funded Facility review will begin shortly. Successful completion of the review will result in proceeds of USD 1.0Bn which are urgently needed given forex reserves have declined considerably ever since the turn of the year and are expected to continue the trend in the wake of high external debt servicing and hefty import bill. Despite these challenges, the PKR underwent robust recovery against the greenback and appreciated by 1.7% during the week to close at PKR 181.6/USD. On the other hand, the index moved between highs and lows of 46,786 and 44,445 points, to settle at 46,602 points (↑4.9% WoW) while volumes surged to 188.4Mn (↑177.9% WoW) and traded value rose to USD 44.7Mn (↑114% WoW). FX reserves have declined to $17 Billion, where reserves with SBP stand at $10.9 Billion mainly on account of high external debt servicing and rising import bill. Moreover, rumours regarding delays in Chinese corporate debt rollover of USD 2.3Bn have caused uncertainty in the financial markets as the country has less than 2 months of import cover left. Rising oil prices are putting a major dent on fiscal space given the fact that fuel prices in the country have been fixed at PKR 150 per litre whereas OGRA has recommended an increase of Rs120 per litre for petroleum products. This will be a major test for the new government given that inflation is already in double digits and is expected to remain elevated in the near term as the international commodity super cycle persists. Similarly, widening trade deficit ( 8MFY22: USD 29.9Bn, ↑72.5% YoY) and external funding gap will require immediate attention.

Ghani Chemicals merges with G3 technologies The newly constructed and revitalised G3 technologies, formerly Service Fabrics, has announced that it has acquired 20 million shares of Ghani Chemicals Industries Limited in an effort by the parent company to essentially merge the two. In a borus filing made by the holding company, Ghani Global Holdings Limited, it announced on Friday that 20 million shares of Ghani Chemicals are to be divested and invested into G3 technologies.

Finnish Development & Impact investor invests in TPL Insurance

TPL Insurance Limited notified in filing on Friday that a Private Limited Company incorporated in Finland, the Finnish Fund for Industrial Cooperation Limited (Finnfund), has signed a share purchase agreement with TPL insurance Limited pertaining to which it shall acquire 20.6 million shares equivalent to 14.97%. The Finnfund would enable TPL insurance to diversify its insurance services in diversified market segments such as the agriculture sector.

STOCK MARKET UPDATES

Renacon Pharma signs substantial construction contracts for expansion of manufacturing facility

A subsidiary of Treet Corporation Limited, Renacon Pharma (pvt.) Limited (RPL), reported on Friday that due to surplus demand, has decided to sign construction contracts to build a new facility and expand current production capacity by 10x.

Mari Petroleum decides to divest from Natural Resources Limited

Through an announcement on the PSX, Mari Petroleum Company Limited reported on Thursday that its management has acquired board approval for the complete divestiture of its holdings of 20.9 million shares in the mining giant, National Resources (Pvt.) Limited.

Supernet completes book-building with a whopping oversubscription of 1.4 times

Book-building for the first IT company to list on the Pakistan Stock Exchange’s GEM board commenced on Tuesday and concluded on Wednesday resulting in a considerable bid size of Rs659 million against an offer of Rs475 million worth of shares. In an announcement by Telecard Limited, the parent company, it outlined the Rs200 are to be received by Telecard Limited while against its Offer for Sale, while the remaining Rs275 million are to be syphoned to Supernet directly.

Shahzad Textile instals an aggregate of 67 knitting machines to enhance manufacturing unit

Shahzad Textile Mills Limited, the textile giant has announced the extension of its Socks & Hosiery manufacturing plant with the installation of 7 local and 60 Italian socks knitting machines as the company intends to ramp up its exports to the EU and US regions.

Landmark Spinning Industries instigates reverse merger with Liven Pharmaceuticals

Landmark Spinning Industries Limited, a financial distressed company, non-operational and going concern textile company has made its decision on the reverse merger talks with Liven Pharmaceuticals (Pvt.) Limited (LPL) and is now to be transformed to a listed pharmaceutical corporation rather than a textile company. In a notification filed on Wednesday, Landmark Spinning Industries announced that Liven Pharmaceuticals shall be merged into Landmark Spinning Industries against approximately 66 million shares issued directly to the shareholders of Liven Pharmaceuticals. ~1667 shares of Landmark Spinning Industries are to be handed out against one share of LPL. After the merger, the name of the company shall be changed to Liven Pharma Limited (LPL) from Landmark Spinning Mills Limited and the principal line of business is to be altered from textile to pharmaceuticals.

NetSol Technologies decides to buy-back 2 million shares at spot rate

NetSol Technologies, the IT giant of Pakistan announced on Monday that it made a decision to repurchase 2 million shares at the ruling market/spot price with the face value of Rs10 each. The announcement said that the buy-back would improve the company’s Earning Per Share (EPS), future dividends and share break-up value.

11