OFFSHORE SUPPLEMENT

30 November 2019

DUGGAN MATTHEWS Chief Investment Officer, Marriott

T

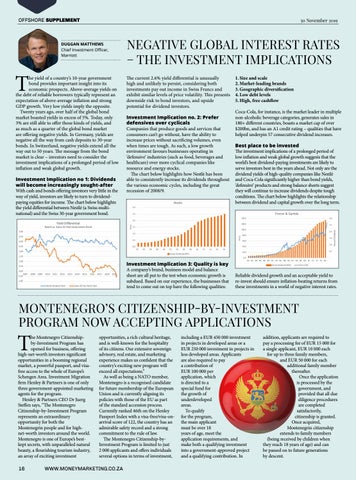

he yield of a country’s 10-year government bond provides important insight into its economic prospects. Above-average yields on the debt of reliable borrowers typically represent an expectation of above-average inflation and strong GDP growth. Very low yields imply the opposite. Twenty years ago, over half of the global bond market boasted yields in excess of 5%. Today, only 3% are still able to offer those kinds of yields, and as much as a quarter of the global bond market are offering negative yields. In Germany, yields are negative all the way from cash deposits to 30-year bonds. In Switzerland, negative yields extend all the way out to 50 years. The message from the bond market is clear – investors need to consider the investment implications of a prolonged period of low inflation and weak global growth. Investment Implication no 1: Dividends will become increasingly sought-after With cash and bonds offering investors very little in the way of yield, investors are likely to turn to dividendpaying equities for income. The chart below highlights the yield differential between Nestlé (a Swiss multinational) and the Swiss 30-year government bond.

NEGATIVE GLOBAL INTEREST RATES – THE INVESTMENT IMPLICATIONS The current 2.6% yield differential is unusually high and unlikely to persist, considering both investments pay out income in Swiss Francs and exhibit similar levels of price volatility. This presents downside risk to bond investors, and upside potential for dividend investors. Investment Implication no. 2: Prefer defensives over cyclicals Companies that produce goods and services that consumers can’t go without, have the ability to increase prices without sacrificing volumes, even when times are tough. As such, a low growth environment favours businesses operating in ‘defensive’ industries (such as food, beverages and healthcare) over more cyclical companies like resource and energy stocks. The chart below highlights how Nestlé has been able to consistently increase its dividends throughout the various economic cycles, including the great recession of 2008/9.

Investment Implication 3: Quality is key A company’s brand, business model and balance sheet are all put to the test when economic growth is subdued. Based on our experience, the businesses that tend to come out on top have the following qualities:

1. Size and scale 2. Market-leading brands 3. Geographic diversification 4. Low debt levels 5. High, free cashflow Coca-Cola, for instance, is the market leader in multiple non-alcoholic beverage categories, generates sales in 180+ different countries, boasts a market cap of over $200bn, and has an A1 credit rating – qualities that have helped underpin 57 consecutive dividend increases. Best place to be invested The investment implications of a prolonged period of low inflation and weak global growth suggests that the world’s best dividend-paying investments are likely to serve investors best in the years ahead. Not only are the dividend yields of high-quality companies like Nestlé and Coca-Cola significantly higher than bond yields, ‘defensive’ products and strong balance sheets suggest they will continue to increase dividends despite tough conditions. The chart below highlights the relationship between dividend and capital growth over the long term.

Reliable dividend growth and an acceptable yield to re-invest should ensure inflation-beating returns from these investments in a world of negative interest rates.

MONTENEGRO’S CITIZENSHIP-BY-INVESTMENT PROGRAM NOW ACCEPTING APPLICATIONS

T

he Montenegro Citizenshipby-Investment Program has opened for business, offering high-net-worth investors significant opportunities in a booming regional market, a powerful passport, and visafree access to the whole of Europe’s Schengen Area. Investment Migration firm Henley & Partners is one of only three government-appointed marketing agents for the program. Henley & Partners CEO Dr Juerg Steffen says, “The Montenegro Citizenship-by-Investment Program represents an extraordinary opportunity for both the Montenegrin people and for highnet-worth investors around the world. Montenegro is one of Europe’s bestkept secrets, with unparalleled natural beauty, a flourishing tourism industry, an array of exciting investment

opportunities, a rich cultural heritage, and is well-known for the hospitality of its citizens. Our extensive sovereign advisory, real estate, and marketing experience makes us confident that the country’s exciting new program will exceed all expectations.” As well as being a NATO member, Montenegro is a recognised candidate for future membership of the European Union and is currently aligning its policies with those of the EU as part of the standard accession process. Currently ranked 46th on the Henley Passport Index with a visa-free/visa-onarrival score of 122, the country has an admirable safety record and a strong commitment to the rule of law. The Montenegro Citizenship-byInvestment Program is limited to just 2 000 applicants and offers individuals several options in terms of investment,

16 WWW.MONEYMARKETING.CO.ZA

including a EUR 450 000 investment in projects in developed areas or a EUR 250 000 investment in projects in less developed areas. Applicants are also required to pay a contribution of EUR 100 000 per application, which is directed to a special fund for the growth of underdeveloped areas. To qualify for the program, the main applicant must be over 18 years of age, meet the application requirements, and make both a qualifying investment into a government-approved project and a qualifying contribution. In

addition, applicants are required to pay a processing fee of EUR 15 000 for a single applicant, EUR 10 000 each for up to three family members, and EUR 50 000 for each additional family member thereafter. Once the application is processed by the government, and provided that all due diligence procedures are completed satisfactorily, citizenship is granted. Once acquired, Montenegrin citizenship extends to family members (being received by children when they reach 18 years of age) and can be passed on to future generations by descent.