Insights // Spring 2021 12

HBK Nonprofit Solutions

Insights Insights //// SSpring pring 2021 2021 13

HBK Nonprofit Solutions

Outside the Lines room is set up like a restaurant, so we’ll adhere to the governor’s rules for how many people can be in that room at any one time. And we’ll need to be sensitive to the comfort levels of our staff and volunteers. Gwydir-Govel. In 2020 we received more donations online than ever before. That forced us to think about our donation process. But there are also people who still want the letter in their hands and to write a check. We’re still going to do virtual events, like an online art auction in April. We hope to have our gala in October, though will likely have to modify how many people we can have on-site. We’ll broadcast it so people can purchase a ticket to watch it. There are a lot of grant opportunities coming up as well. And the American Rescue Plan Act of 2021 includes funding for nonprofits. At shutdown, we knew it was going to be difficult financially for people, but the community stepped up instantly with donations. As things improve, people might not think we need as much support. But in New Jersey, food insecurity was up 56 percent in 2020. Our area was hit really hard because we are a service industry, the shore hotels and restaurants. Those folks were just getting by before the pandemic, then lost their jobs with no safety net and no savings. Those industries are going to come back slowly, we’ve heard maybe not until 2024. HBK. We’ve been honored to be involved with Lunch Break, providing audit and tax services and mentoring to your accounting staff, but also using our resources to support Lunch Break, for example, connecting you to a nonprofit insurance specialist and providing guidance with donation compliance issues. When did you decide to bring on a CPA firm that specialized in working with nonprofits? Love. When we reached an amount of donations that required a fullblown audit, we established an auditing committee and hired a firm. Then after a few years, we realized that we needed more expertise and sent out an RFP. That’s when we met you, Kathy, and your firm. We were impressed by your presentation and decided to make the change. Ever since, the audits have gone smoothly and the committee has been very pleased. You and your HBK team always make a great presentation to the committee. Having that level of professional expertise as you grow is absolutely necessary. There are so many types of funding, and we’re not going to have in-house personnel with the knowledge that requires. There are always questions of what language to use, how to report this or that. HBK has made sure that we’re compliant with what we’re telling our donors. And there are questions that come up with a new campaign. We want the donors to be able to see that the organization is operating ethically. We’ve always had a great level of confidence that HBK is taking care of those things, that we can tend to our business and not worry about any of that.

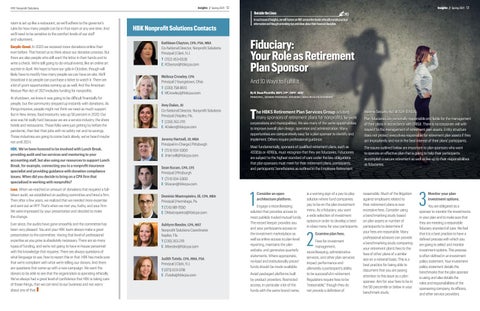

HBK Nonprofit Solutions Contacts Kathleen Clayton, CPA, PSA, MBA Co-National Director, Nonprofit Solutions Principal | Clark, N.J. T (732) 453-6528 E KClayton@hbkcpa.com Melissa Crowley, CPA Principal | Youngstown, Ohio T (330) 758-8613 E MCrowley@hbkcpa.com Amy Dalen, JD Co-National Director, Nonprofit Solutions Principal | Naples, Fla. T (239) 263-2111 E ADalen@hbkcpa.com Jeremy Hartzell, JD, MBA Principal-In-Charge | Pittsburgh T (724) 934-5300 E JHartzell@hbkcpa.com Sean Kocan, CPA, CFE Principal | Pittsburgh T (724) 934-5300 E SKocan@hbkcpa.com Dominic Mastropietro, III, CPA, MBA Principal | Hermitage, Pa. T (724) 981-7550 E DMastropietro@hbkcpa.com Ashlynn Reeder, CPA, MST Nonprofit Solutions Coordinator Naples, Fla. T (239) 263-2111 E AReeder@hbkcpa.com Judith Tutela, CPA, RMA, PSA Principal | Clark, N.J. T (973) 629-5118 E JTutela@hbkcpa.com

In each issue of Insights, we will feature an HBK service line leader who will provide practical information and thought-provoking tips and ideas about their financial discipline.

Fiduciary: Your Role as Retirement Plan Sponsor And 10 Ways to Fulfill It By R. Dean Piccirillo, MSFS, CFP®, CRPS®, AIFA® PRINCIPAL, SENIOR FINANCIAL ADVISOR | HBKS WEALTH ADVISORS

T

Income Security Act of 1974 (ERISA).

corporations and municipalities. We see many of the same opportunities to improve overall plan design, operation and administration. Many opportunities are comparatively easy for a plan sponsor to identify and implement. Others require professional guidance.

Plan fiduciaries are personally responsible and liable for the management of their plans in accordance with ERISA. There is no corporate veil with respect to the management of retirement plan assets. Entity structure does not protect executives responsible for retirement plan assets if they act imprudently and not in the best interest of their plans’ participants.

Most fundamentally, sponsors of qualified retirement plans, such as 403(b)s or 401(k)s, must recognize that they are fiduciaries. Fiduciaries are subject to the highest standard of care under the law, obligations that plan sponsors must meet for their retirement plans, participants, and participants’ beneficiaries as outlined in the Employee Retirement

The issues outlined below are important to plan sponsors who want to operate an effective plan that is going to help their participants accomplish a secure retirement as well as live up to their responsibilities as fiduciaries.

he HBKS Retirement Plan Services Group advises many sponsors of retirement plans for nonprofits, for-profit

1

Consider an open architecture platform.

Engage a recordkeeping solution that provides access to most publicly traded mutual funds. The record keeper provides you and your participants access to the investment marketplace as well as online access to plan-level reporting, maintains the plan website, and generates quarterly statements. Where appropriate, no-load and institutionally priced funds should be made available. Avoid packaged platforms built by product providers. Restricted access, in particular a lot of the funds with the same brand name,

is a warning sign of a pay-to-play solution where fund companies pay to be on the plan investment menu. As a fiduciary, you want a wide selection of investment options in order to develop a bestin-class menu for your participants.

2

Examine plan fees.

Fees for investment management, recordkeeping, administrative services, and other plan services impact performance and ultimately a participant’s ability to be successful in retirement. Regulators require fees to be “reasonable,” though they do not provide a definition of

reasonable. Much of the litigation against employers related to their retirement plans is over excessive fees. Consider using a benchmarking study based on plan assets or number of participants to determine if your fees are reasonable. Many professional advisors can provide a benchmarking study comparing your retirement plan’s fees to the fees of other plans of a similar size on a national basis. This is a best practice for being able to document that you are paying attention to this issue as a plan sponsor. Aim for your fees to be in the 50 percentile or below in your benchmark study.

3

Monitor your plan investment options.

You are obligated as a sponsor to monitor the investments in your plan and to make sure that they are meeting a reasonable fiduciary standard of care. We feel that it is a best practice to have a defined process with which you are going to select and monitor investment options. This process is often defined in an investment policy statement. Your investment policy statement details the benchmarks that the plan sponsor is using and also details the roles and responsibilities of the sponsoring company, its officers, and other service providers.