C H AO S

Data insights to drive real estate transactions By Paloma Bautista

T

raditionally, the real estate industry has taken investment decisions on a case-by-case basis based on limited data, such as that from transactions, property owners, or type of investment, and that from personal networking. The insights produced in this case-by-case model easily become outdated in a constantly changing ecosystem. The current pandemic has impulsed digital transformation around the globe and forced the adoption of methods that deliver fact-based responses in a timely manner. Decisions based on outdated data and personal knowledge are not sustainable. We need to look forward, detect trends and understand how the world, its citizens, and their needs are changing. “At the heart of CHAOS we believe that insights driven by demand — in other words, people — provide more accurate predictions and forecasts to support decision-making in real estate,” says Natalia Rincón, PhD in Smart cities and CEO at CHAOS. Today, there is more than enough information that can be analysed together to better understand the performance of specific locations. Yet, the challenge that real estate professionals face is figuring out how to leverage data science for maximum impact, bridging the gap between scattered data and holistic insights. Bridging the gap between data and business insights In order to stay ahead of the curve in a fast-changing

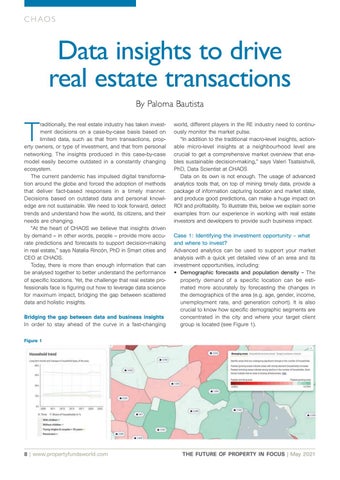

world, different players in the RE industry need to continuously monitor the market pulse. “In addition to the traditional macro-level insights, actionable micro-level insights at a neighbourhood level are crucial to get a comprehensive market overview that enables sustainable decision-making,” says Valeri Tsatsishvili, PhD, Data Scientist at CHAOS Data on its own is not enough. The usage of advanced analytics tools that, on top of mining timely data, provide a package of information capturing location and market state, and produce good predictions, can make a huge impact on ROI and profitability. To illustrate this, below we explain some examples from our experience in working with real estate investors and developers to provide such business impact. Case 1: Identifying the investment opportunity – what and where to invest? Advanced analytics can be used to support your market analysis with a quick yet detailed view of an area and its investment opportunities, including: • Demographic forecasts and population density – The property demand of a specific location can be estimated more accurately by forecasting the changes in the demographics of the area (e.g. age, gender, income, unemployment rate, and generation cohort). It is also crucial to know how specific demographic segments are concentrated in the city and where your target client group is located (see Figure 1).

Figure 1

8 | www.propertyfundsworld.com

THE FUTURE OF PROPERTY IN FOCUS | May 2021