OV E RV I E W

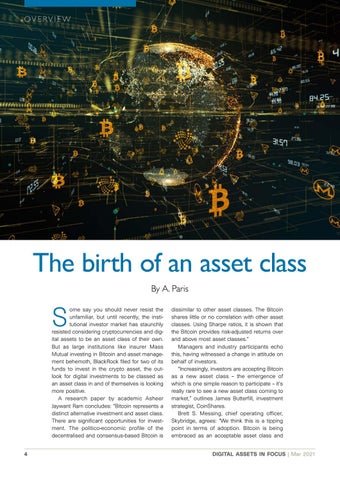

The birth of an asset class By A. Paris

S

ome say you should never resist the unfamiliar, but until recently, the institutional investor market has staunchly resisted considering cryptocurrencies and digital assets to be an asset class of their own. But as large institutions like insurer Mass Mutual investing in Bitcoin and asset management behemoth, BlackRock filed for two of its funds to invest in the crypto asset, the outlook for digital investments to be classed as an asset class in and of themselves is looking more positive. A research paper by academic Asheer Jaywant Ram concludes: “Bitcoin represents a distinct alternative investment and asset class. There are significant opportunities for investment. The politico-economic profile of the decentralised and consensus-based Bitcoin is 4

dissimilar to other asset classes. The Bitcoin shares little or no correlation with other asset classes. Using Sharpe ratios, it is shown that the Bitcoin provides risk-adjusted returns over and above most asset classes.” Managers and industry participants echo this, having witnessed a change in attitude on behalf of investors. “Increasingly, investors are accepting Bitcoin as a new asset class – the emergence of which is one simple reason to participate – it’s really rare to see a new asset class coming to market,” outlines James Butterfill, investment strategist, CoinShares. Brett S. Messing, chief operating officer, Skybridge, agrees: “We think this is a tipping point in terms of adoption. Bitcoin is being embraced as an acceptable asset class and DIGITAL ASSETS IN FOCUS | Mar 2021