2 minute read

Taking Care of Business

According to our “Statement of Financial Position” report, as of June 30, 2021 we had a total of $319,000 in cash and cash equivalents. This includes money in the Operating, Designated and Capital Funds and is approximately $189,000 less than last year at this time, as we continue to draw on our cash reserves to balance our budgets. Our fixed assets (for things such as our land, building, furniture, equipment, etc.) have an estimated value of $10.26 million, for a combined total of $10.58 million in assets.

Designated & Restricted Funds

Advertisement

In our Designated & Restricted Fund account, we ended the year with nearly $47,000 across eleven funds. The two largest - Wartmann Lecture Series (with approx. $16,000) and Arnie and Sam Clay Fund (with approx. $9,000) - are the cumulative distributions from the FUS Foundation, which we will aim to fully spend down each year.

Operating Fund

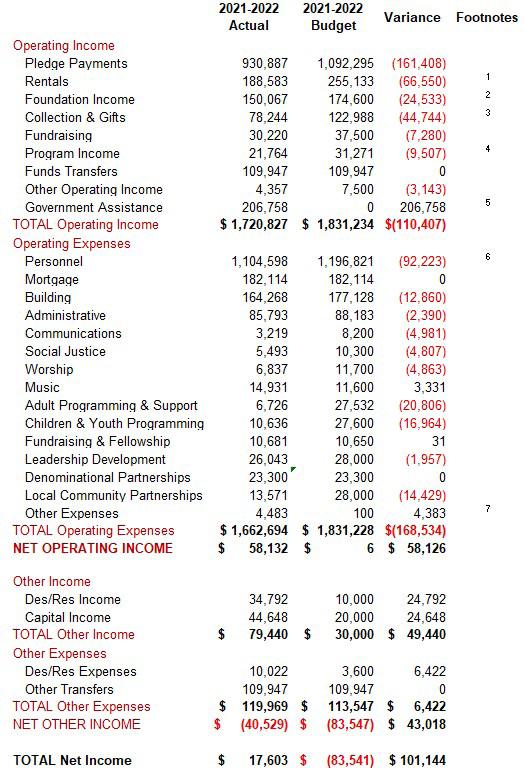

Last fiscal year in the Operating Fund we anticipated roughly $1,831,000 in income and expenses, projecting a tiny six-dollar surplus. Though our actual income fell short of its budgeted goal by 6% with $1,721,000 received, we also saw major savings and were 10% under budgeted expenses, therefore completing the year with a $58,000 operating budget surplus. That surplus would not have been possible without this community’s generosity – with $931,000 in pledge payments, member contributions remain our largest source of income. Though we continue to watch our communities’ decline in pledges and pledge payments with concern, we know that we will continue to find ways of enacting our vision and mission within our means. Though all of our traditional income sectors fell short of their annual budgeted goals, the “Government Assistance” line played a critical role in another successful fiscal year, with $207,000 in Paycheck Protection Program funds fully forgiven and attributed on last year’s reports. Across three fiscal years, we’re grateful for the half million dollars that we’ve received in government assistance, with the last of which from the Employee Retention Credit landing in July of 2022. On the expense side of the Operating Fund, we spent a whopping $169,000 less than budgeted, a testament to staff’s frugal and creative methods for implementing meaningful programs and services with minimal impact on the budget. I hope you’ll take a minute to review the Statement of Financial Activities included. As always, please don’t hesitate to reach out to myself or the Finance Committee if you have questions about our financial state. You can reach me at monican@fusmadison.org or our Finance Committee Chairperson, Adam Simcock at awsimcock@gmail.com.

Monica Nolan, Executive Director