VSCPA

2020 Outstanding Member: Mike Gracik Jr., CPA When Virginia native Mike Gracik Jr., CPA, attended the

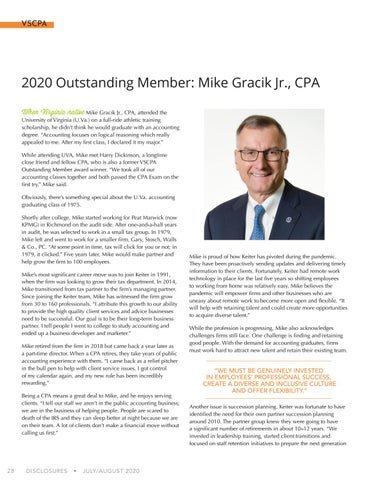

University of Virginia (U.Va.) on a full-ride athletic training scholarship, he didn’t think he would graduate with an accounting degree. “Accounting focuses on logical reasoning which really appealed to me. After my first class, I declared it my major.” While attending UVA, Mike met Harry Dickinson, a longtime close friend and fellow CPA, who is also a former VSCPA Outstanding Member award winner. “We took all of our accounting classes together and both passed the CPA Exam on the first try,” Mike said. Obviously, there’s something special about the U.Va. accounting graduating class of 1975. Shortly after college, Mike started working for Peat Marwick (now KPMG) in Richmond on the audit side. After one-and-a-half years in audit, he was selected to work in a small tax group. In 1979, Mike left and went to work for a smaller firm, Gary, Stosch, Walls & Co., PC. “At some point in time, tax will click for you or not; in 1979, it clicked.” Five years later, Mike would make partner and help grow the firm to 100 employees. Mike’s most significant career move was to join Keiter in 1991, when the firm was looking to grow their tax department. In 2014, Mike transitioned from tax partner to the firm’s managing partner. Since joining the Keiter team, Mike has witnessed the firm grow from 30 to 160 professionals. “I attribute this growth to our ability to provide the high quality client services and advice businesses need to be successful. Our goal is to be their long-term business partner. I tell people I went to college to study accounting and ended up a business developer and marketer.” Mike retired from the firm in 2018 but came back a year later as a part-time director. When a CPA retires, they take years of public accounting experience with them. “I came back as a relief pitcher in the bull pen to help with client service issues. I got control of my calendar again, and my new role has been incredibly rewarding.” Being a CPA means a great deal to Mike, and he enjoys serving clients. “I tell our staff we aren’t in the public accounting business; we are in the business of helping people. People are scared to death of the IRS and they can sleep better at night because we are on their team. A lot of clients don’t make a financial move without calling us first.”

28

DISCLOSURES

•

JULY/AUGUST 2020

Mike is proud of how Keiter has pivoted during the pandemic. They have been proactively sending updates and delivering timely information to their clients. Fortunately, Keiter had remote work technology in place for the last five years so shifting employees to working from home was relatively easy. Mike believes the pandemic will empower firms and other businesses who are uneasy about remote work to become more open and flexible. “It will help with retaining talent and could create more opportunities to acquire diverse talent.” While the profession is progressing, Mike also acknowledges challenges firms still face. One challenge is finding and retaining good people. With the demand for accounting graduates, firms must work hard to attract new talent and retain their existing team.

“WE MUST BE GENUINELY INVESTED IN EMPLOYEES’ PROFESSIONAL SUCCESS, CREATE A DIVERSE AND INCLUSIVE CULTURE AND OFFER FLEXIBILITY.” Another issue is succession planning. Keiter was fortunate to have identified the need for their own partner succession planning around 2010. The partner group knew they were going to have a significant number of retirements in about 10–12 years. “We invested in leadership training, started client transitions and focused on staff retention initiatives to prepare the next generation