8 minute read

Tax Base

Each of Connecticut’s 169 municipalities maintains a Grand List: an official record of all taxable property as of October 1 each year. This list forms the foundation of the property tax system and reflects the total assessed value of real estate, personal property, and motor vehicles within a town’s borders. The Grand List determines the community’s tax base and directly informs the calculation of the mill rate needed to fund municipal services.

The mill rate is the tax rate applied to the assessed value of a property to calculate property taxes. It’s expressed as the amount of tax owed per $1,000 of a property’s assessed value.

Property Types and Assessment

There are three primary categories of taxable property in Connecticut:

Real property: Land and buildings, including residential, commercial, and industrial structures

Personal property: Tangible business assets such as machinery, equipment, and furnishings

Motor vehicles: Assessed annually using standardized valuation guides (e.g., NADA)

All taxable property is assessed at 70% of fair market value, as required by state law. Local Assessor’s Offices are responsible for identifying and valuing each taxable asset using one or more of the following methods:

Market approach: Based on recent sales of comparable properties

Cost approach: Estimates replacement cost of structures minus depreciation

Income approach: Applied to income-producing properties, based on projected revenue streams

Each municipality must conduct a revaluation of real property every five years, either through statistical modeling or full physical inspections. The purpose is to ensure that assessments remain current with local market conditions. If revaluations are delayed, significant tax shifts may occur, especially in neighborhoods experiencing rapid appreciation, potentially leading to taxpayer dissatisfaction and appeals.

If a property owner believes their assessment is inaccurate or unfair, they may appeal to the Board of Assessment Appeals, typically by March following the October 1 valuation date. Successful appeals may result in adjusted assessments and affect the town’s overall tax base.

Property Assessment and Budget Development

Once finalized, the Grand List feeds directly into the municipal budget process, which usually begins in January or February. Department heads—including those from public works, police, education, fire, and social services—submit funding requests to the town’s Finance Director or Town Manager. These are reviewed, consolidated into a proposed operating budget, and passed to the Board of Finance (or an equivalent body) for approval and public presentation.

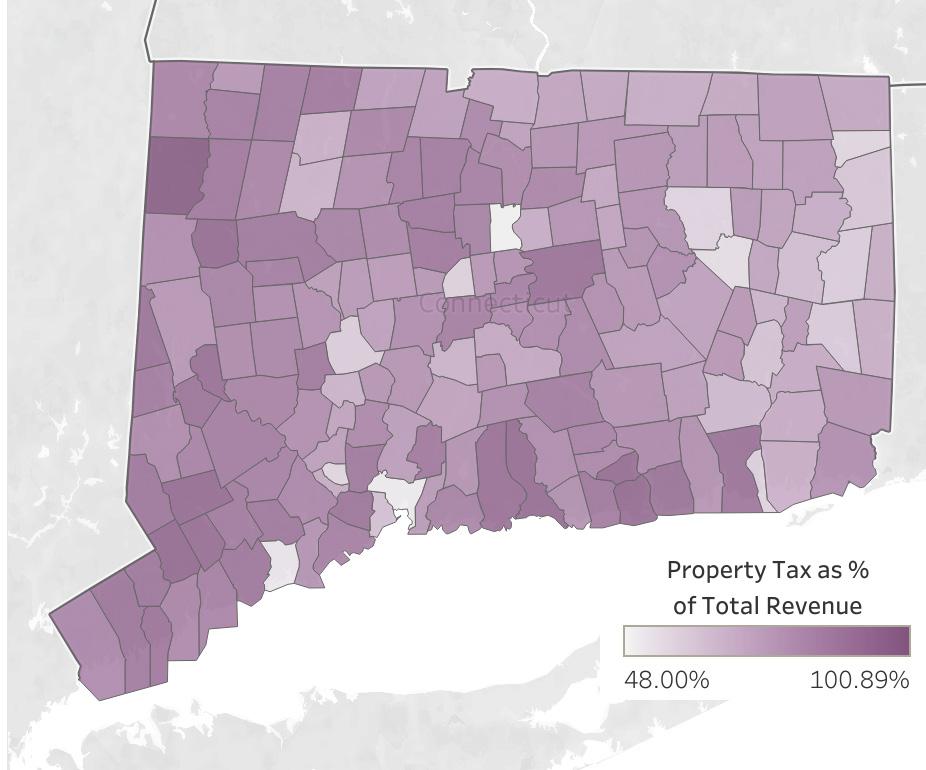

To determine how much revenue must be raised through property taxes, town officials first estimate all non-tax revenues, such as state aid, fees, or federal grants. The remaining balance is the Net Property Tax Requirement—the portion that must be generated through the local tax base.

The mill rate is then calculated using the following formula:

Mill Rate = (Net Property Tax Requirement ÷ Net Grand List) × 1,000

Example:

If a town requires $60 million in tax revenue and its Net Grand List is $2 billion, the resulting mill rate is 30.

The Link Between Services, Expectations, and the Mill Rate

It’s important to note that a town’s mill rate is not just a product of its property values; it also reflects the scope of services the community expects or demands. For example, towns with larger school districts, fulltime public safety departments, or more extensive infrastructure may have higher tax requirements. In contrast, reducing service levels, such as limiting road maintenance or scaling back recreation programs, may reduce expenses and, possibly, the mill rate. The mill rate is ultimately a reflection of both the community’s ability to pay and the level of services it chooses to provide.

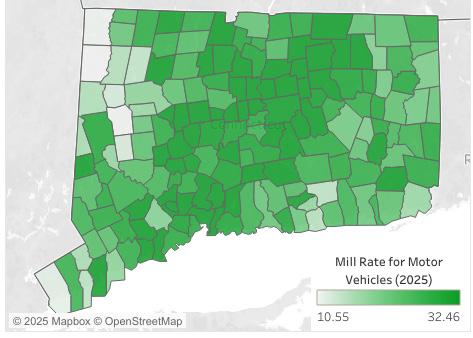

Motor Vehicle Property Tax and State Cap

In addition to real and personal property, Connecticut towns tax motor vehicles annually as part of their Grand List. Vehicles are assessed based on a depreciated value schedule issued by the Office of Policy and Management (OPM), and then taxed using the local mill rate. However, due to longstanding concerns about disparities, the state implemented a motor vehicle mill rate cap, currently set at 32.46 mills (C.G.S. §4-66l).

This cap ensures that the same vehicle is not taxed dramatically differently across municipalities. For instance, a vehicle valued at $10,000 would owe no more than $324.60 in taxes, regardless of whether it’s garaged in a town with a 45-mill general rate.

To compensate towns whose standard mill rate exceeds the cap, as of 2025 the state provides a Motor Vehicle Property Tax Reimbursement Grant, funded through the Municipal Revenue Sharing Account (MRSA). The reimbursement is calculated based on the difference between the town’s regular rate and the capped rate, multiplied by the total value of eligible vehicles.

Example:

If a town’s regular mill rate is 40, and its vehicle list totals $100 million in assessed value, the town would collect only 32.46 mills. The remaining 7.54 mills would be reimbursed by the state, subject to available appropriations.

While this cap helps equalize vehicle taxation, towns with higher base rates rely on state reimbursements to maintain their budgets. Delays or underfunding in reimbursements create fiscal uncertainty.

Payment in Lieu of Taxes (PILOT)

Another factor affecting municipal budgeting is the Payment in Lieu of Taxes (PILOT) program. Certain properties, particularly those held by the state, private institutions, nonprofit hospitals, and federally exempt entities, are not subject to property tax, even if they benefit from municipal services. The PILOT program is intended to partially reimburse towns for this lost revenue.

There are three major categories:

State-Owned Property PILOT (C.G.S. §12-19a)

College & Hospital PILOT (C.G.S. §12-20a)

Tax-exempt Manufacturing Equipment PILOT (C.G.S. §12-18b)

Under the tiered PILOT system, the state is supposed to reimburse a percentage of estimated tax losses by community wealth:

Tier 1 (most distressed): 53% reimbursement

Tier 2: 43%

Tier 3 (wealthier): 33%

Payments are distributed each fall (by September 30). Although entitlement is formula-based, actual payments vary year-to-year and are subject to state budget appropriations. Unfortunately, as a result many towns receive only a portion of their statutory grant, potentially forcing residents to shoulder a larger share of municipal costs.

This gap between statutory expectations and actual funding can significantly impact urban municipalities like Hartford, New Haven, and Bridgeport, where tax-exempt properties make up a large portion of the real estate footprint. In response, recent reforms have implemented a tiered PILOT framework, increasing reimbursement percentages for fiscally distressed towns. Even so, many communities continue to highlight PILOT underfunding as a major budget challenge.

Budget Adoption and Tax Collection

Final budget approval involves public hearings, workshops, and in some towns, referenda, ensuring transparency and community participation. Once adopted (typically by late spring) the mill rate is set, and tax bills are issued. Many towns have charter-defined deadlines requiring the budget to be finalized before July 1, the start of the new fiscal year.

The Tax Collector oversees the billing and enforcement process. Responsibilities include issuing tax bills, maintaining records, applying interest on delinquent balances (1.5% per month), and initiating collection actions such as liens or foreclosure proceedings if necessary.

To maintain professional standards, Connecticut administers a Certified Municipal Collector (CCMC) program. According to the 2020 CCMC guide, the average tax collection rate across towns is about 98%, indicating both high compliance and effective local administration.

Tax Exemptions

Connecticut offers a broad range of statutorily mandated and optionally authorized exemptions and abatements intended to support veterans, seniors, farms, businesses, and other priority groups. These provisions can significantly reduce taxable values and impact municipal tax bases.

A. State-Mandated Exemptions

Veterans Exemptions

Totally Disabled Veterans and their surviving spouses are fully exempt from tax on their principal residence, associated land, and one motor vehicle (§ 12-81(19)–(21), § 12-94). Honorably Discharged Veterans (non-disabled) are entitled to a flat exemption of $1,000–2,000 (§ 12-81(19)), with optional income-based enhancements under § 12-81g .

Disability and Blindness

Homeowners who are totally disabled or legally blind qualify for $1,000–3,000 in exemptions under § 12-81(18) and (23).

Elderly/Disabled Homeowner Credit

Individuals aged 65+ or totally disabled, earning below specified thresholds, can claim a credit up to $1,250 for married filers or $1,000 for singles (§ 12-170aa).

Military Vehicle Exemption

Active-duty military personnel, including non-residents stationed in-state, may exempt one vehicle annually with commanding officer certification (§ 12-81(20), § 12-94).

Tools, Equipment, and Environmental

Exemptions apply to mechanic’s tools, certain business inventory, farm equipment, and environmentally beneficial machinery (§ 12-81(60), § 12-81(68)).

B. Agricultural & Business Incentives

Farm Machinery & Equipment

Exempt up to $250,000 in assessed value of farm machinery and equipment (§ 12-91, per PA 24-86).

Farmland & Open-Space Classification (PA-490)

Qualifying land may receive preferential tax assessment based on use-value; local authorities may offer up to 50% abatement.

Industrial & Enterprise Zone Exemptions

New manufacturing machinery and eligible enterprise zone properties can receive up to five years of abatement, with 80% reductions in designated zones (§ 12-81(60), § 12-81(68)).

C. Locally Authorized Exemptions

Municipalities may choose to provide additional exemptions (without state reimbursement) for purposes such as:

Enhanced veteran or elderly benefits (income-based)

Vehicle tax exemptions beyond state minimums

Volunteer fire/rescue personnel

Rehabilitation and historic preservation

Nonprofit, cultural, and affordable housing property relief

These are governed by municipal ordinance and criteria vary widely.

D. Other Reimbursements & Budget Considerations

State reimbursement ensures that mandated exemptions, like those for veterans, elderly, disabled, blindness, and active-duty vehicles, do not reduce municipal revenues.

Exemptions tied to business or farm incentives may receive partial or no reimbursement, depending on state appropriation.

Local abatements carry no state compensation, effectively shifting the tax burden to other taxpayers.

Assessment of fiscal impact is critical for municipal offices to maintain balanced budgets while supporting local priorities.