11 minute read

Walking the SMSF loan tightrope

There is a fine line between what is considered an SMSF loan and what is deemed the illegal early access of superannuation benefits. ASF Audits head of technical Shelley Banton examines the elements that separate the two types of actions.

If the purpose of superannuation is to build a nest egg to provide for retirement, why do the ATO statistics for 2022/23 reveal the most commonly reported contraventions are related to loans or financial assistance to members?

Representing 19 per cent of total contraventions, SMSF trustees are more likely to raid the fund’s bank account when they are financially stressed in either their personal or professional lives.

The ATO estimated SMSF trustees illegally accessed about $250 million in the 2022 financial year, with an additional $232 million withdrawn as loans to members.

While members are allowed to access their super after meeting a condition of release, and there are some legitimate reasons why a member can use their super beforehand, it does not always play out that way.

Unfortunately, there is a fine line between providing a loan and illegal early access of benefits, with SMSF trustees walking the compliance tightrope in the eyes of the ATO.

Illegal early access

Where trustees access some or all of their retirement savings without meeting a condition of release, it is considered illegal early access.

The most common conditions of release include when the member:

• has reached their preservation age and retires,

• has reached their preservation age and begins a transition-to-retirement income stream,

• ceases an employment arrangement on or after the age of 60,

• is 65 years of age (even if they haven’t retired), or

• has died.

There are also special conditions of release before a member reaches their preservation age that include:

• terminating gainful employment,

• permanent incapacity,

• temporary incapacity,

• severe financial hardship,

• compassionate grounds,

• terminal medical condition, and

• First Home Super Saver Scheme.

While SMSF members may also be encouraged by promoters of illegal early access schemes to withdraw money from their SMSFs, the trustees will still be held responsible by the ATO.

It is essential to note that funds obtained through an early release of money cannot be reimbursed and any attempt to return these funds will be considered a new contribution by the member.

Penalties for illegal early access

Where a member withdraws money without meeting a condition of release, there are significant tax and financial consequences.

The withdrawal is classified as illegal early access and taxed as ordinary income at the member’s marginal tax rate, regardless of whether it was made intentionally or in error.

Where a trustee contravenes section 166 of the Superannuation Industry (Supervision) (SIS) Act, an administrative penalty is imposed by law. The ATO’s application of the penalty is outlined in Practice Statement Law Administration (PSLA) 2020/3.

Different administrative penalties will apply depending on the specific breach associated with illegal early access. With a penalty unit currently worth $330, a breach of sections 65 and 84 of the SIS Act is worth $19,800 per contravention and a breach of section 34(1) is worth $6600 per contravention.

Trustee behaviour and circumstances will factor into the tax commissioner’s decision to remit the penalty in full, partially or not at all. The ATO will administer the penalties in line with the following four basic steps:

1. determine if a penalty is imposed by law,

2. determine who is liable for the penalty,

3. determine if remission is appropriate,

4. notify each trustee or each director to the corporate trustee of the liability to pay the penalty.

Let us take the example of James and Judy, both individual trustees of the JJ Super Fund, who authorised 10 withdrawals of $5000 from the fund’s bank account to purchase a new car.

The multiple withdrawals resulted from the financing arrangements for the purchase, which spanned over 10 months.

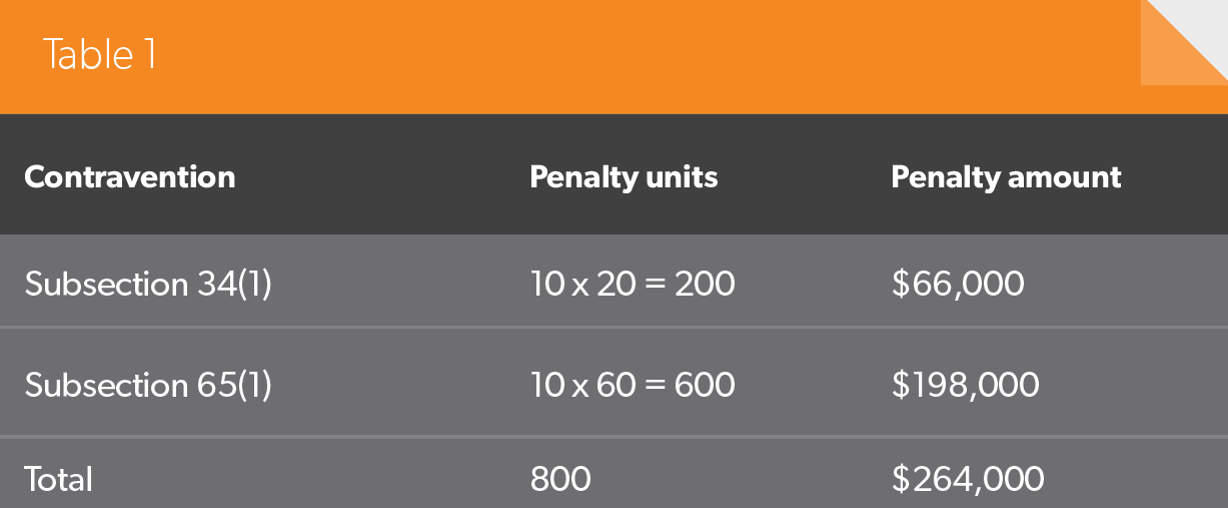

The trustees contravened sections 34 and 65 of the SIS Act 10 times because a condition of release was not met, resulting in the penalties as in Table 1.

As individual trustees, James and Judy are liable to pay $264,000 each before any penalties are remitted.

Based on the principles outlined in PSLA 2020/3, the ATO has determined the primary contravention occurs under subsection 34(1) and remits the total penalty by 600 penalty units (the section 65 penalty).

The ATO will also consider further remission because even though there were multiple withdrawals, they stemmed from a single course of conduct or behaviour.

By comparison, if the trustees had authorised access to money from their SMSF multiple times for separate courses of conduct, further remission may not be appropriate.

Can an SMSF lend money?

The answer is yes, as long as it is in the best interests of the member and the sole purpose test is met.

The loan must also comply with SIS Regulation 4.09 and be allowed by the trust deed to ensure trustees meet their obligations under the covenants.

Where an SMSF has a bona fide loan agreement in place, it must be signed by both parties and established on commercial terms that comply with the arm’s-length requirements under Section 109 of the SIS Act before drawdown commences.

It means neither party has more favourable terms than the other and the transaction is one SMSF trustees would gladly enter into with a stranger.

Lending to a related party

While section 65 of the SIS Act prohibits a trustee from lending money to members, relatives and business partners, section 71 allows an SMSF to lend up to 5 per cent of the market value of the fund’s assets to a related company or trust.

Once again, the loan must be on arm’slength terms, with both parties acting in line with the signed and dated loan agreement.

Where the loan exceeds the 5 per cent limit, dictated by the in-house asset provisions, at the end of the financial year the trustees must put a plan in place to dispose of the excess to 5 per cent or less by the end of the following income year. If this action is not taken, a breach of section 82 of the SIS Act will have occurred.

Regardless of whether market fluctuations adjust the excess back to 5 per cent or less in the following income year, the trustee is still required to dispose of the excess from the previous year.

It is important to note an SMSF is prohibited from lending money to a related entity that complies with SIS Regulations 13.22C and 13.22D. According to the rules, for the Regulation 13.22C entity to maintain its status as an exempt asset under the inhouse asset provisions, it must not extend a loan to another entity or incur a borrowing.

Genuine loans

The ATO is concerned SMSF trustees are disguising illegal early access actions as loans to members or relatives. While both are reportable compliance breaches under sections 62 and 65 of the SIS Act, respectively, trustees may actually be accessing money illegally and subsequently drawing up loan documents.

The purpose is to give these types of drawdowns a degree of acceptability as a loan to a member, thereby reducing the perceived risk of the breach in the eyes of the ATO.

Even if the trustee genuinely made an error by withdrawing money from the fund’s bank account instead of their personal account, the ATO’s position is that history cannot be rewritten.

A genuine loan to a member will have a loan agreement in place on arm’s-length terms with regular interest repaid and all other terms met. It is not enough that the principal of the loan is repaid in a lump sum without interest when it is discovered during the audit.

What can also happen is that the error gets classified as a sundry debtor in the financials, which is then quickly changed to a loan to a member once queried by the auditor.

An even worse outcome is when the sundry debtor is reclassified as a loan to a related company or trust after being discovered during an audit.

The issue, once again, is that the trustee provides the draft loan documentation with the amended financials and the terms of the loan have not been met. The signed documents are then provided at the end of the audit before the final audit report is issued.

Under these circumstances, where the amount withdrawn exceeds $30,000 or the 5 per cent in-house asset limit, the loan is reported to the ATO as an in-house asset and breach of section 84 of the SIS Act.

Fraudulent loan documentation

Whether trustees fraudulently backdate loan documents is not the concern of SMSF auditors. They receive various types of draft documents during the audit, including commercial limited recourse borrowing arrangements, and obtain the signed documents at the end.

SMSF auditors are required to use professional judgment and experience to provide an opinion on whether the financial report as a whole is free from material misstatement.

The SMSF independent auditor’s report states that “the risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error as fraud may involve collusion, forgery, intentional omissions, misrepresentations or the override of an internal control”.

As a result, fraud and other illegal acts can only be detected where the audit procedures are designed to identify such acts, as seen in the Melissa Caddick case.

While SMSF auditors must independently confirm and verify the existence of assets in an investment report through their audit procedures, they cannot identify fraud from a draft Word document. Where they are found to be false and misleading, SMSF trustees will be liable for penalties from the ATO.

When an SMSF professional is involved in backdating documents, they risk compromising their professional accreditation as fraud can result in ATO fines, referral to their professional body or criminal charges laid due to illegal behaviour.

Trustee disqualification

In its “Levelling-up SMSF Compliance: The Regulator’s Update” (QC 101234), published in February 2024, the ATO reported 66 per cent of illegal early access cases involved individuals who had joined the system without intending to run an SMSF and disqualified 692 trustees that financial year.

A further 462 were disqualified in the nine months to March 2025, demonstrating the ATO has no hesitation in disqualifying SMSF trustees who use the fund’s bank account for personal reasons.

Trustee disqualification is permanent, with the names on the public record forever. It could appear in any background check, which can also affect the person’s personal and professional reputation.

The ATO holds SMSF professionals to a higher standard. Disqualified trustees who are SMSF auditors or hold an Australian financial services licence are referred to the Australian Securities and Investments Commission, while tax agents are referred to the Tax Practitioners Board.

While there is no single set of prescriptive rules the ATO follows to disqualify a trustee, factors contributing to its decision depend on the seriousness of the contravention, the number of contraventions that have occurred and the likelihood the trustee will continue to be non-compliant.

Voluntary disclosure

Voluntary disclosure allows SMSF trustees to disclose contraventions that have not been rectified to the ATO voluntarily.

Anecdotal evidence suggests dealing with the ATO through the early engagement voluntary disclosure process for high-risk breaches, such as illegal early access, may provide better outcomes for trustees than waiting for the regulator to conduct its own review.

The voluntary disclosure form must state only the facts and include any supporting documentation. Most importantly the trustee must include either a rectification proposal or a proposed enforceable undertaking in the form.

The proposal should be clear and provide terms that rectify the breach as soon as possible. Treating the repayment of illegal early access in the same manner as a personal bank loan would not be well received.

The ATO expects trustees to actively engage with it and demonstrate measures have been implemented to prevent similar contraventions in the future.

Where there is a disagreement between the trustee and the SMSF auditor regarding whether a transaction constitutes a loan to a member or illegal early access, the trustee should apply to the ATO for SMSF-specific advice.

Conclusion

The high-risk nature of prohibited loans in an SMSF means that when an auditor lodges an auditor contravention report, the ATO will respond accordingly.

Regardless of whether the transaction is classified as an SMSF loan or illegal early access, SMSFs are walking a compliance tightrope.

Non-lodgers, promoters of illegal early access schemes and early access disguised as loans to members are all red flags to the ATO that can result in removal from Super Fund Lookup, an ATO audit, trustee disqualifications and severe financial and tax consequences.

Education remains the key to ensuring SMSF trustees stay on the path to compliance and maintain the integrity and safety of the superannuation system.